BONK Exhibits a 12% Increase over 24 Hours - Potential Factors Sustaining the Surge

Hi there! Let's dive into the world of BONK [BONK], a cryptocurrency that's been making waves recently.

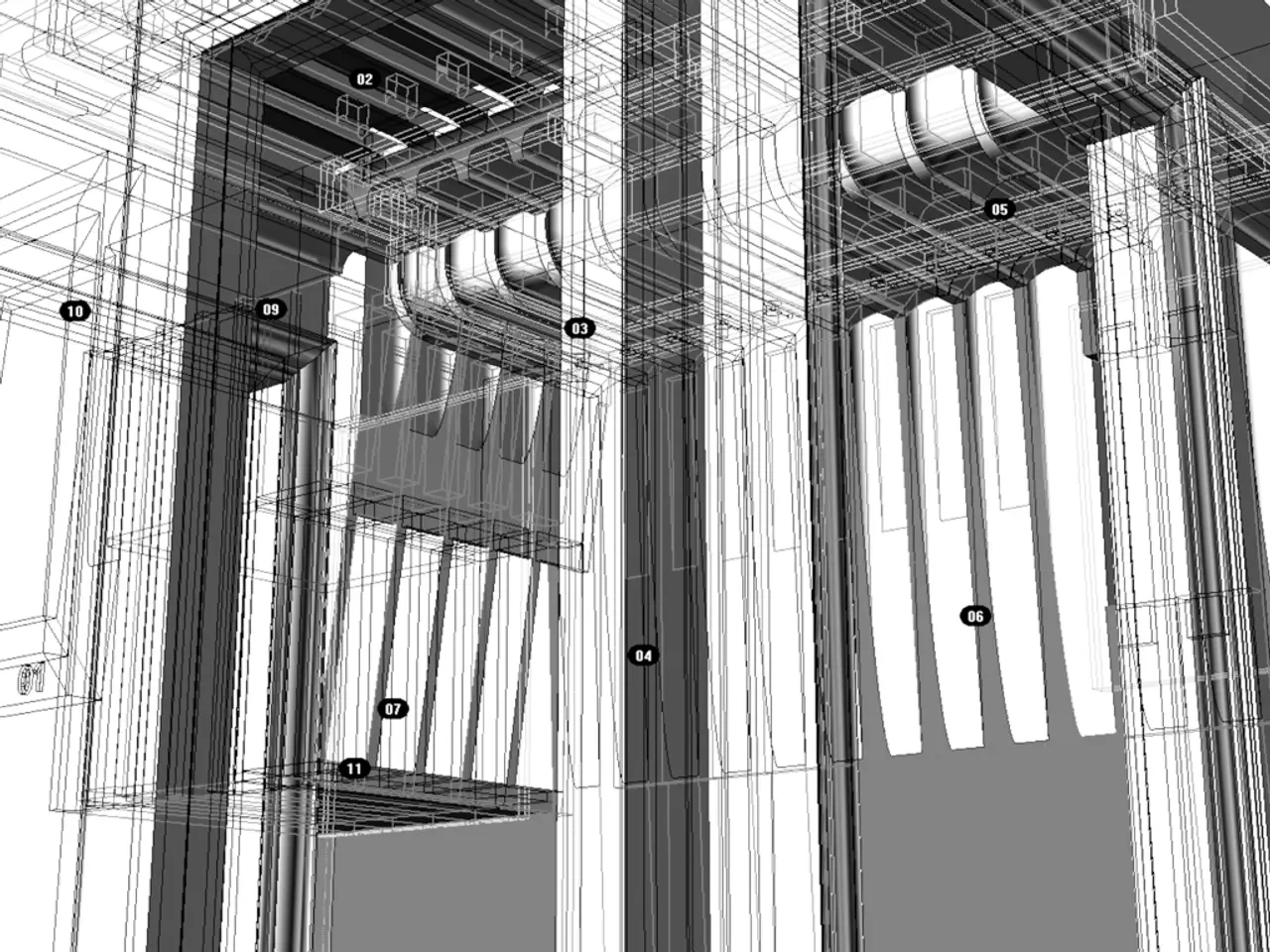

After a 12.56% surge in the past 24 hours, BONK now trades at $0.00001595. This move broke through a multi-month descending channel, suggesting a potential trend reversal could be underway. But there's more to this story.

If the current bullish momentum holds and BONK manages to breach the $0.00001900 resistance, it could soar as high as $0.00003257 – that's a potential 108% gain! However, if the resistance holds strong, BONK might take a brief dip toward the $0.00001350-$0.00001400 range before recovering.

Derivatives and the Bulls

The derivatives market is buzzing with activity. Open Interest, a measureof traders' commitment to positions, has spiked by 17.28%, hinting that confident investors are piling into BONK with a bullish outlook. This uptick in Open Interest is a sign of conviction-driven moves, not just noise from short-term chasers.

Funding Rate: A Positive Signal

Interestingly, the OI-Weighted Funding Rate has turned positive, indicating a renewed bullish bias in the market. This shift is significant because, just a few weeks ago, the funding was neutral-to-negative, with shorts dominating sentiment. Now, traders are paying a premium to hold long positions, a sign that demand for upside exposure is growing.

Exchange Outflows: Hodlers Strike Back

On-chain data shows a net outflow of $1.39 million from centralized exchanges. This move suggests that BONK holders are opting for long-term storage over immediate trading, reducing the circulating supply and alleviating sell-side pressure. Historically, exchange outflows of this magnitude often accompany breakout rallies, as holders anticipate future gains.

Shorts Squeeze: The Wild Card

As BONK pushes higher, it's encountering a critical liquidity zone with heavy short positions between $0.01520 and $0.01650. If the price keeps climbing, these shorts could face liquidation risk, leading to a series of forced buying and potentially a full-fledged squeeze. With traders using high leverage, especially at 10x and 25x, a cascade of liquidations could propel BONK past the $0.00001900 barrier, unlocking acceleration toward the $0.00003257 target.

In conclusion, a confluence of factors, including rising Open Interest, positive funding rates, dominant exchange outflows, and liquidation risk, point to increasing bullish momentum for BONK. If the $0.00001900 level is flipped into support, BONK could extend its rally toward the $0.00003257 target in the coming days. Buckle up, folks – it's time to catch the BONK rally!

As always, be cautious and do your own research before making any investment decisions.

- The derivatives market is witnessing heightened activity with a 17.28% surge in Open Interest for BONK, showing investors are confidently piling into the cryptocurrency with a bullish perspective.

- Interestingly, the OI-Weighted Funding Rate has also turned positive, reflecting a renewed bullish bias in the market as traders are now paying a premium to hold long positions.

- On-chain data reveals a net outflow of $1.39 million from centralized exchanges, indicating that BONK holders are favoring long-term storage over immediate trading, thereby reducing the circulating supply and relieving sell-side pressure.

- As BONK advances, it encounters a critical liquidity zone with substantial short positions between $0.01520 and $0.01650. If the price keeps escalating, these short positions could potentially face liquidation risk, triggering a series of forced buying and possibly a full-fledged squeeze.

- With traders employing high leverage, especially at 10x and 25x, a sequence of liquidations could catapult BONK beyond the $0.00001900 barrier and propel it towards the $0.00003257 target.