It's All About LINK: A Closer Look at Chainlink's Recent Performance and Future Prospects

Chainlink's Current State

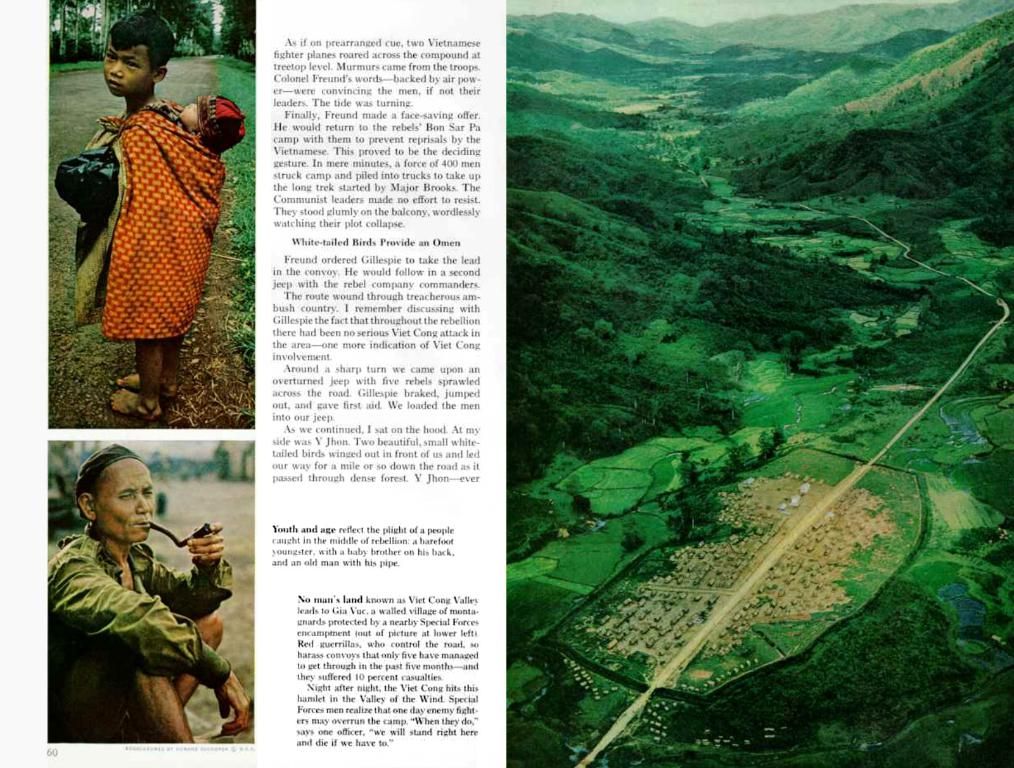

Bullish pattern emerges in Chainlink price as whale holdings increase

Whale Activity: Large-scale investors, known as whales, have been amassing LINK in recent times, a phenomenon that suggests they're bullish on the coin's future performance. Keeping an eye on whale transactions can offer valuable insights into market trends.

Trading Status: At the moment, Chainlink (LINK) is hovering around $14.20, up by about 45% from its yearly low. Despite a temporary sideways movement, the token displays signs of potential growth.

Technical Indicators

Rebound Potential: LINK has shown remarkable resilience, bouncing back from a low of $9.9720 in April to its current level. The coin has formed two significant technical patterns: a falling wedge and an inverse head and shoulders. These patterns are commonly associated with bullish reversals, indicating a potential upward trend.

Future Predictions

Technical Forecasts:- The next major target for LINK could be $20, a significant increase of about 30% from the current price.- In May 2025, LINK's average price might hover around $13.24, with potential drops to $9.17 or rises to $17.30.- By June 2025, trading ranges could be between $11.67 and $14.07.- As we move towards the end of 2025, the LINK price might reach approximately $14.10.

Partnerships and Expansion:- Swift and DTCC: Both Swift and DTCC are exploring the integration of Chainlink's Cross-Chain Interoperability Protocol into their systems. This partnership could strengthen Chainlink's presence in the market and potentially boost its price.- Booming Blockchain and DeFi: The growth of blockchain technology and decentralized finance might significantly increase the demand for Chainlink's services, continuing the coin's upward trajectory.

Cautionary Notes

Market Volatility: Like other cryptocurrencies, LINK is susceptible to volatility, causing sudden price variations influenced by market sentiment and event-driven news.

Competition and Innovation: The burgeoning blockchain and oracle landscape offers challenges and opportunities. To maintain a competitive edge and solid market position, Chainlink may need to innovate and expand its service offerings.

In conclusion, while Chainlink's short-term outlook hints at potential challenges caused by market volatility, its longer-term prospects seem compelling due to the growth of blockchain technology and decentralized finance, partnered with key agreements such as those with Swift and DTCC. For a comprehensive analysis of specific partnerships or whale activities, further investigation is required. Game on!

- Large-scale investors, known as whales, have been accumulating Chainlink (LINK), a token on the Ethereum blockchain, indicating a bullish sentiment towards the coin's future performance.

- At present, Chainlink is trading around $14.20, up by approximately 45% from its yearly low, hinting at its potential growth.

- LINK has rebounded remarkably from a low of $9.9720 in April, forming technical patterns such as a falling wedge and an inverse head and shoulders, which are usually associated with bullish reversals.

- According to technical forecasts, the next major target for LINK could be $20, representing a significant increase of about 30% from the current price.

- Partnerships with entities like Swift and DTCC, coupled with the growing adoption of blockchain technology and decentralized finance, could further boost Chainlink's price and enhance its market position.

- Despite encouraging prospects, investors should be mindful of market volatility, competition, and the need for continued innovation to ensure Chainlink maintains its competitive edge.