Enhancing Insurance Services through Customisation: Focus on Client-Oriented Strategies

In the ever-evolving world of insurance, a significant shift is underway as companies embrace hyper-personalization, driven by artificial intelligence (AI), machine learning, and big data analytics. This transformation allows insurers to offer tailored coverage based on individual behaviour and implement dynamic pricing models, such as pay-as-you-drive for auto insurance.

Key trends in this transformation include smarter risk assessment and underwriting, personalised customer experiences, on-demand insurance models, and advanced fraud detection and claims management. Predictive analytics uses real-time, dynamic data from sources like wearable health devices, smart home sensors, and driving behaviour to enhance risk prediction accuracy and enable fairer pricing. Data analytics facilitates customised policies and interactions, improving client satisfaction and loyalty by delivering more relevant products and services.

On-demand insurance models provide flexible, usage-based, or event-specific coverage options, disrupting traditional long-term contracts and opening new revenue streams like micro-insurance and cyber insurance. Advanced AI and analytics help identify fraud patterns faster and automate claims processing through image recognition and severity assessment, thus improving operational efficiency and customer service.

However, this transformation comes with challenges. Regulatory and compliance hurdles are a concern, as on-demand and hyper-personalized insurance products often require navigating evolving regulatory frameworks. Data privacy and security risks are raised as collecting large volumes of personal and behavioural data may lead to concerns about customer privacy and the security of sensitive information.

Insurers also face the challenge of improving overall customer satisfaction amid market competition and demands for seamless, multi-channel experiences. Market competition and differentiation are key issues, as the growth of on-demand and hyper-personalized insurance has increased market saturation, requiring insurers to clearly distinguish their offerings and value propositions.

Health insurers are capitalising on this trend by leveraging wearable technology to monitor physical activity and overall health metrics, offering discounts or rewards to customers who maintain a healthy lifestyle and reduce claims. Home insurance benefits from smart home devices, offering insights for tailored coverage or risk mitigation advice. Travel insurance adapts to travellers' itineraries, activities, and preferences.

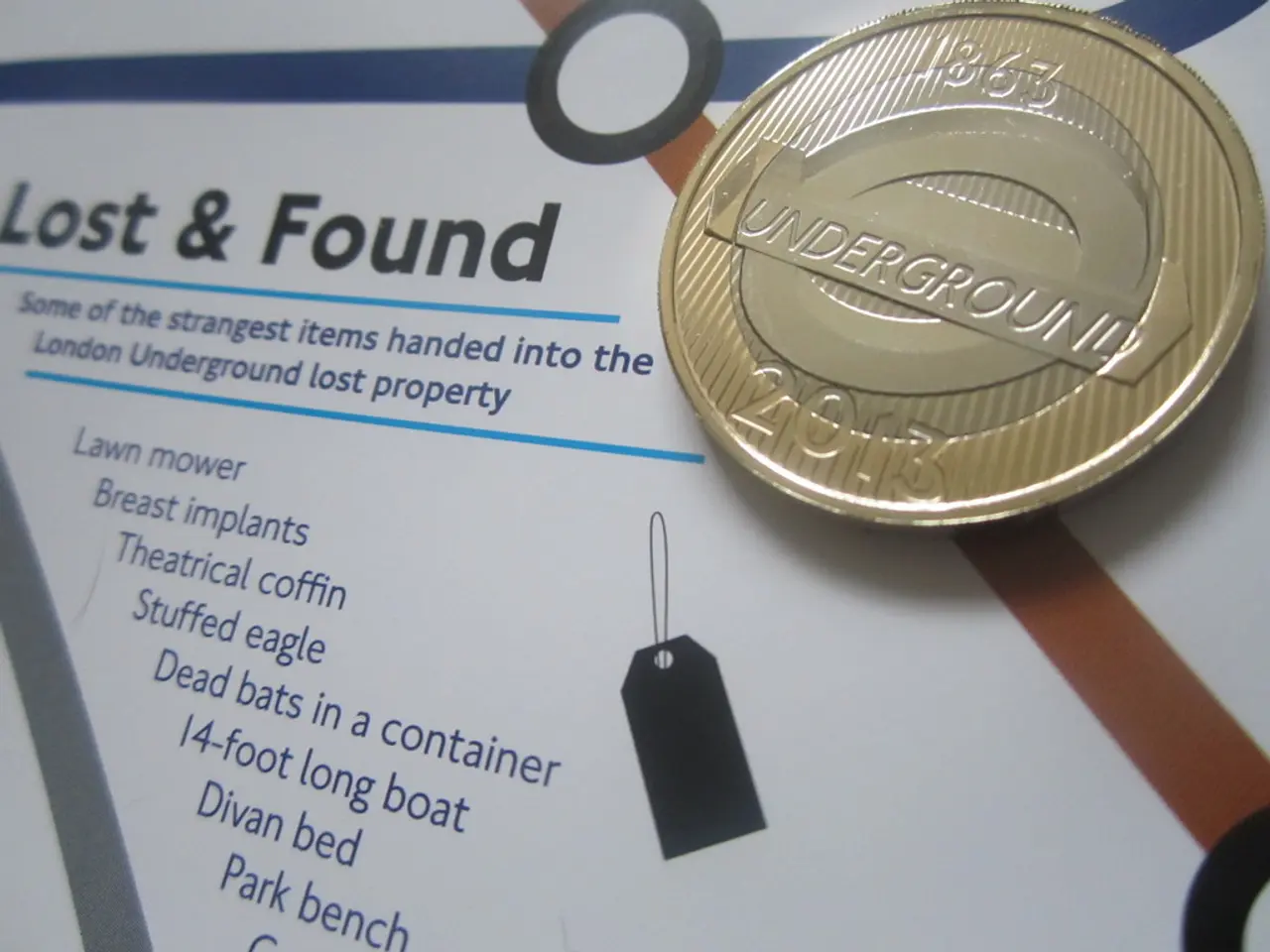

Personalisation extends to physical customer touchpoints, such as using personalised labels on policy documents, welcome kits, or claims correspondence. However, the risk of over-complexity exists, as offering highly customised products may lead to confusion among customers or inefficiencies in policy management.

Building infrastructure for data collection, processing, and customisation can be costly for insurers. Yet, customers now demand greater transparency, flexibility, and relevance in their interactions with businesses, and personalised insurance meets these expectations. Emerging technologies such as machine learning, blockchain, and predictive analytics allow insurers to tailor products efficiently.

Charles Taylor Insurtech is ensuring global clients are at the forefront of this personalisation journey in the insurance industry. The head of EMEA Business at Charles Taylor InsureTech, Jeremy Stevens, discusses the trend towards personalisation in the insurance sector. As the industry continues to evolve, it is clear that personalised insurance is set to accelerate, promising a more customised and efficient future for policyholders.

[1] Hyper-personalization in Insurance: A New Era of Customer Experience. (2021). Retrieved from https://www.accenture.com/t20210528t064217z__w__/us-en/_acnmedia/Accenture/Conversion-Assets/DotCom/Documents/Global/PDF/Insurance/Personalization-in-Insurance-A-New-Era-of-Customer-Experience.pdf

[2] The Future of Personalization in Insurance. (2020). Retrieved from https://www.capgemini.com/resources/the-future-of-personalization-in-insurance/

[3] The Future of Insurance: Personalization and the Impact of Emerging Technologies. (2021). Retrieved from https://www.deloitte.com/insights/us/en/focus/insurance/future-of-insurance-personalization-and-impact-of-emerging-technologies.html

[4] Personalization in Insurance: Driving Customer Satisfaction and Retention. (2020). Retrieved from https://www.accenture.com/us-en/insights/insurance/personalization-insurance-customer-satisfaction-retention-trends-study

- The evolution of insurance includes innovation with hyper-personalized products, utilizing AI, machine learning, and big data analytics, intending to offer individualized coverage through dynamic pricing models like pay-as-you-drive for auto insurance.

- Regulation and compliance present challenges during this transformation, as on-demand and hyper-personalized insurance products navigate evolving regulatory frameworks to ensure proper operation.

- On-demand insurance models provide flexible, usage-based, or event-specific coverage options, making way for micro-insurance and cyber insurance while addressing fraud detection and claims management effectively with AI and analytics.

- Insurers must respond to market competition and provide seamless, multi-channel experiences, addressing market saturation and setting their offerings apart by clearly defining value propositions.

- Improving customer satisfaction remains essential as personalization extends to everything from physical documentation to digital interactions, though avoiding over-complexity is critical to maintain simplicity and avoid confusion among customers.