Globally, smartphone shipments have decreased, yet African market is thriving, with Tecno and Itel leading the growth

In the global smartphone market, Q2 2025 saw a slight dip of 1% in shipments, marking the end of a six-quarter growth streak [1]. Despite this downturn, one company is bucking the trend - Transsion.

Transsion, known for brands like Tecno, Infinix, and itel, continues to dominate the African smartphone market. The company's success is not solely due to one factor, but a strategic approach that caters to local consumer needs [1][3].

Samsung, on the other hand, had a successful quarter, shipping 57.5 million devices, largely thanks to the popularity of their A-series lineup [2]. However, Samsung's success is not exclusive to the A-series. The company has already been catering to the African market to some extent [2].

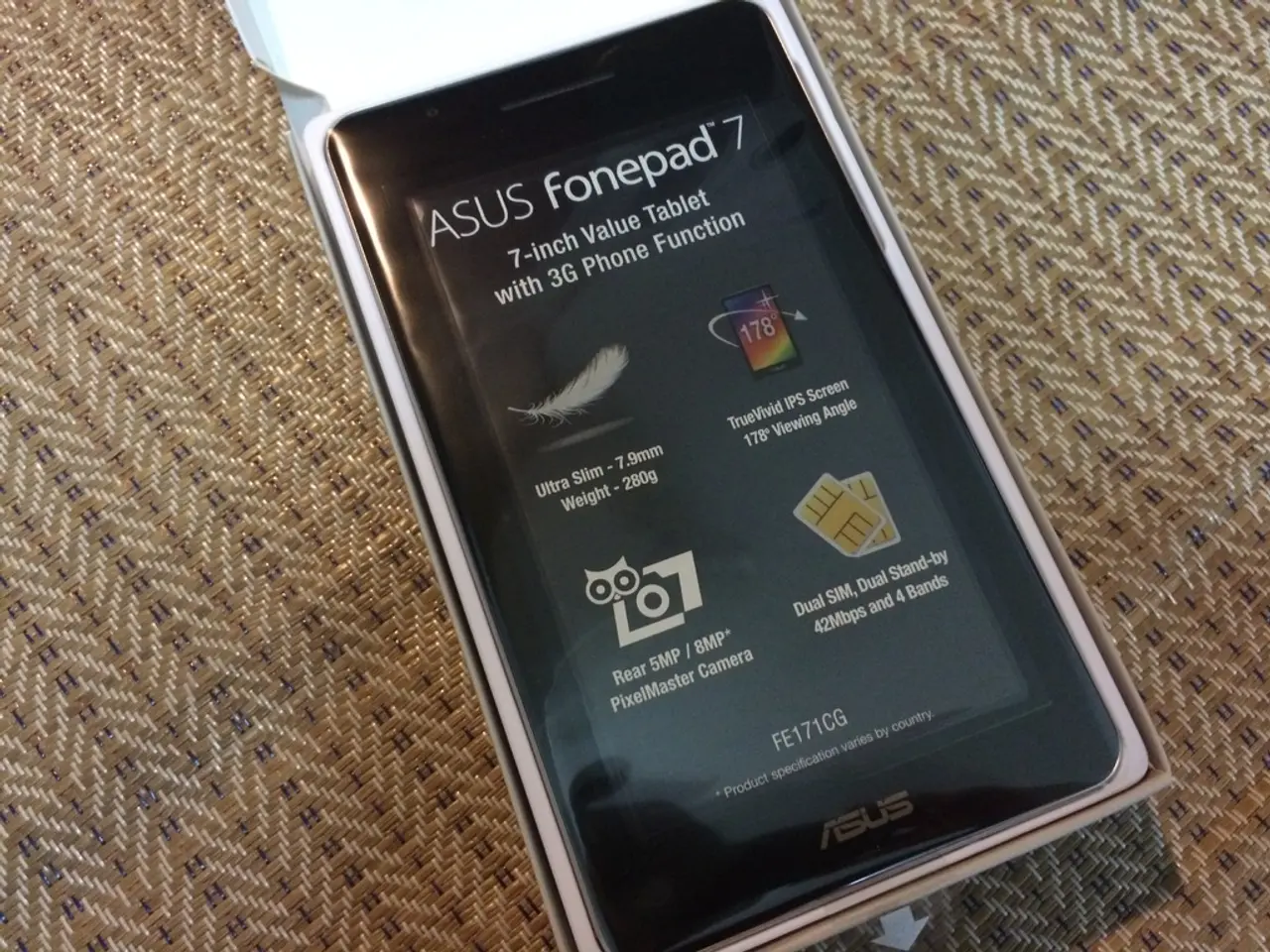

The A-series lineup, in particular, has found favour in Zimbabwe. Transsion's focus on affordability, long battery life, dual SIM capabilities, and cameras calibrated for darker skin tones has resonated with African consumers [1][3]. This strategy has allowed Transsion to maintain a strong hold despite competition.

Meanwhile, Transsion's revenue has faced headwinds due to growing competition. To fund expansion beyond Africa into Asia, the Middle East, and Latin America, the company is planning a secondary IPO in Hong Kong [1][4].

In contrast, the demand for high-end smartphone upgrades is waning, with people holding onto their phones longer [5]. This slowing demand can be attributed to economic factors and a lack of excitement in high-end upgrades [5].

The global slowdown is evident in regions like North America, Europe, and parts of Asia, where demand for smartphones is decreasing [6]. However, Africa remains a growth market for smartphones, as more people are getting online for the first time and bundles are becoming cheaper [6].

The success of a new brand, Nothing, suggests that innovation can drive growth in the smartphone market. Nothing shipped over a million phones this quarter, growing 177% year-on-year [7].

In the quarter, Samsung's entry-level A0x and A1x lines were key drivers, with the Galaxy A06 5G contributing to gains in emerging markets [8]. The S25 series maintained steady performance, but the Galaxy S25 Edge did not experience a significant increase in demand [8]. This may be due to the design not being appealing enough to boost demand, potentially necessitating a rumored redesign.

Apple saw a slight decline in shipments, which may indicate a slowing global economy [9]. Despite this, Africa continues to offer opportunities for growth in the smartphone market.

References:

- Transsion's dominance in Africa amid a global slowdown

- Samsung's success in Q2 2025

- Transsion's strategy in Africa

- Transsion's plans for expansion

- Slowing demand for high-end smartphones

- Africa as a growth market for smartphones

- The success of Nothing

- Samsung's Q2 2025 performance

- Apple's Q2 2025 shipments

Transsion's success in the African smartphone market, despite the slight dip in global smartphone shipments, can be attributed to their strategic approach that caters to local consumer needs, focusing on affordability, long battery life, dual SIM capabilities, and cameras calibrated for darker skin tones.

Meanwhile, the growing competition in the global smartphone market has led Transsion to plan a secondary IPO in Hong Kong, with aims to fund expansion beyond Africa into Asia, the Middle East, and Latin America.