Investors ought to take heed of the current precautions concerning XRP, a move they should not disregard at present.

In the rapidly evolving world of cryptocurrencies, XRP finds itself at a pivotal moment, with significant developments unfolding in its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC).

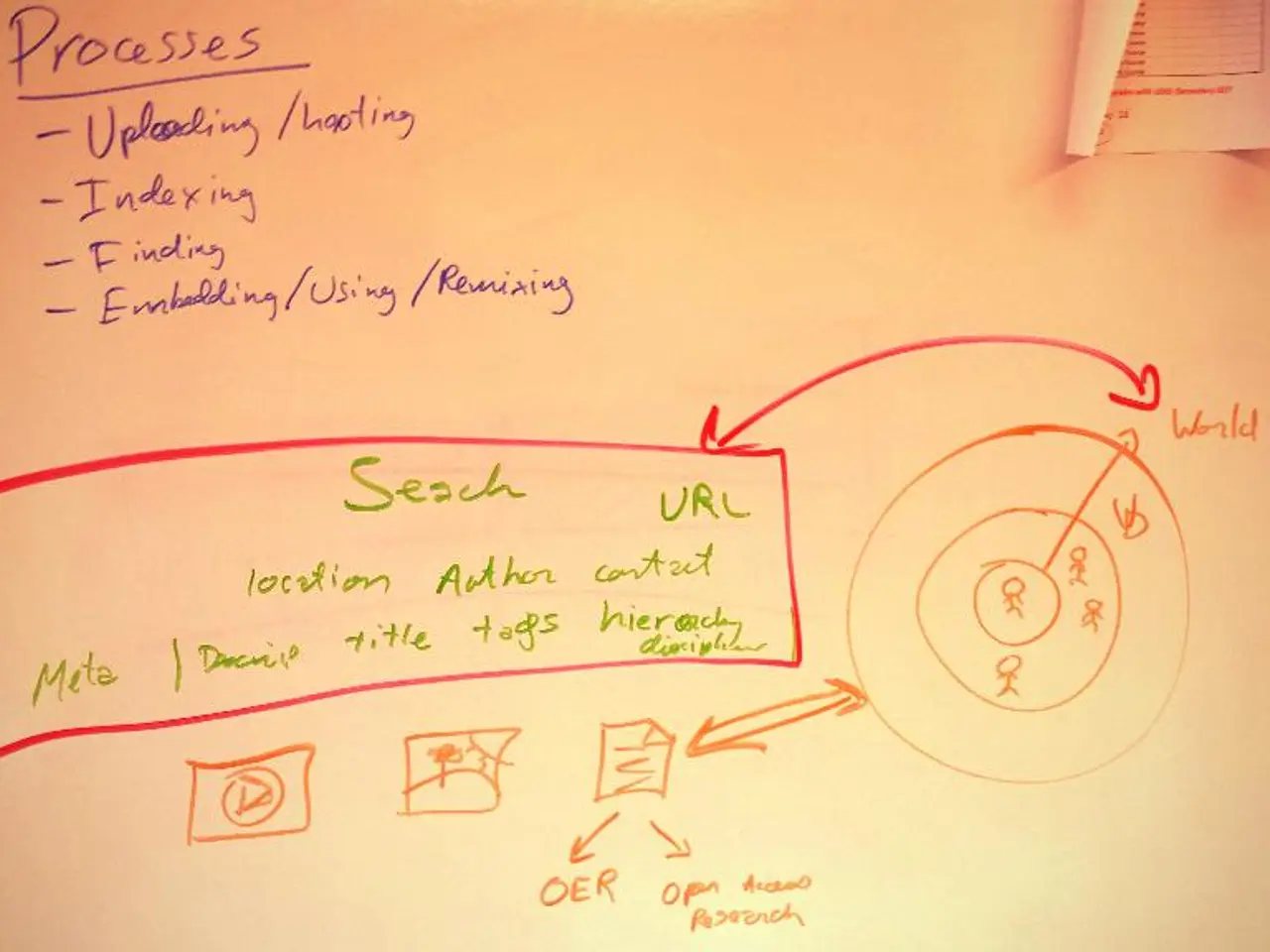

Ivan Gonzalez, a seasoned expert in investments and cryptocurrencies, is offering a medium-level certificate course in Technical Analysis of Cryptocurrencies to help investors navigate this dynamic market. The course, which is free and consists of 7 lessons, is open for immediate enrollment.

Meanwhile, XRP's native network, the XRP Ledger, has been pioneering the sector since 2012 by integrating a decentralized exchange (DEX) platform, one of the first in the industry.

The potential for technological advancements, compatible regulatory progress, and a favorable financial context could significantly boost XRP's price in the short and medium term. This optimism is shared by the XRP community and market experts, who project that the digital asset could reach values between $3 and $5 in 2021.

Progress towards a possible resolution of the SEC case is being made, but its outcome remains uncertain. Ripple has announced that it will drop its cross-appeal against the SEC, and the SEC is expected to withdraw its own appeal. However, a proposed settlement that would have reduced Ripple's civil penalty to $50 million and dissolved the permanent injunction was rejected by Judge Analisa Torres. Ripple will accept a civil penalty of $125 million, and a permanent injunction is likely to remain in place.

The expected end of the lawsuit will remove years of legal uncertainty for XRP, providing clarity on its regulatory status. With reduced uncertainty, there could be increased interest in developing new market products for XRP, such as spot XRP ETFs.

The news of the lawsuit's progression initially led to a modest increase in XRP's price, reflecting positive sentiment. The resolution of the lawsuit is seen as a positive development for Ripple and the broader crypto industry, potentially boosting XRP's adoption and market value.

It is important to note that the investment in crypto assets is not fully regulated and may not be suitable for retail investors due to its high volatility and the risk of losing the entire amount invested. XRP, in particular, has a deflationary model, where the amount in circulation decreases over time due to transaction fee mechanisms.

XRP is gaining prominence in the tokenization of real assets, expanding its utility and appeal in multiple sectors. However, increasing competition from networks like Stellar (XLM) and Algorand (ALGO) intensifies the pressure on XRP to consolidate and demonstrate its unique value.

The course offered by Ivan Gonzalez covers how the market works and how prices affect investor behavior. XRP operates on a decentralized network called the XRP Ledger (XRPL). The digital asset is at a critical juncture in its history, with the potential to transform the digital financial industry.

In recent developments, XRP has been integrated with markets, with the recent launch of futures contracts by CME, the approval of a spot ETF in Canada, and the search for similar products in the U.S. market. Despite the legal challenges, XRP is criticized for significant control by Ripple Labs, but experts and co-founders argue it promotes security and transparency.

As the legal case nears a conclusion and the regulatory landscape evolves, the future of XRP remains uncertain but promising. The upcoming key date to watch is July 10, 2025, when the SEC has a scheduled closed-door meeting that may include a vote to formally withdraw its appeal against Ripple, marking a potential final step in ending the case.

In conclusion, the conclusion of the lawsuit could significantly improve XRP's regulatory environment and market prospects. The evolution of regulatory and adoption challenges will determine XRP's trajectory in the coming months. The price of XRP is currently trading near $2.20, reflecting market confidence despite setbacks.

Other technology, like the XRP Ledger, has been pioneering the cryptocurrency sector since 2012, integrating a decentralized exchange platform. Investing in cryptocurrencies, including XRP, could be influenced by advancements in technology, favorable financial context, and regulatory progress.