Stocks of Bullish company leap up by 5% in response to crypto exchange's intended USA growth following approval of NY license

Bullish Gains Approval to Operate in the U.S. Stock Market, Bolstering its Presence in the Crypto Market

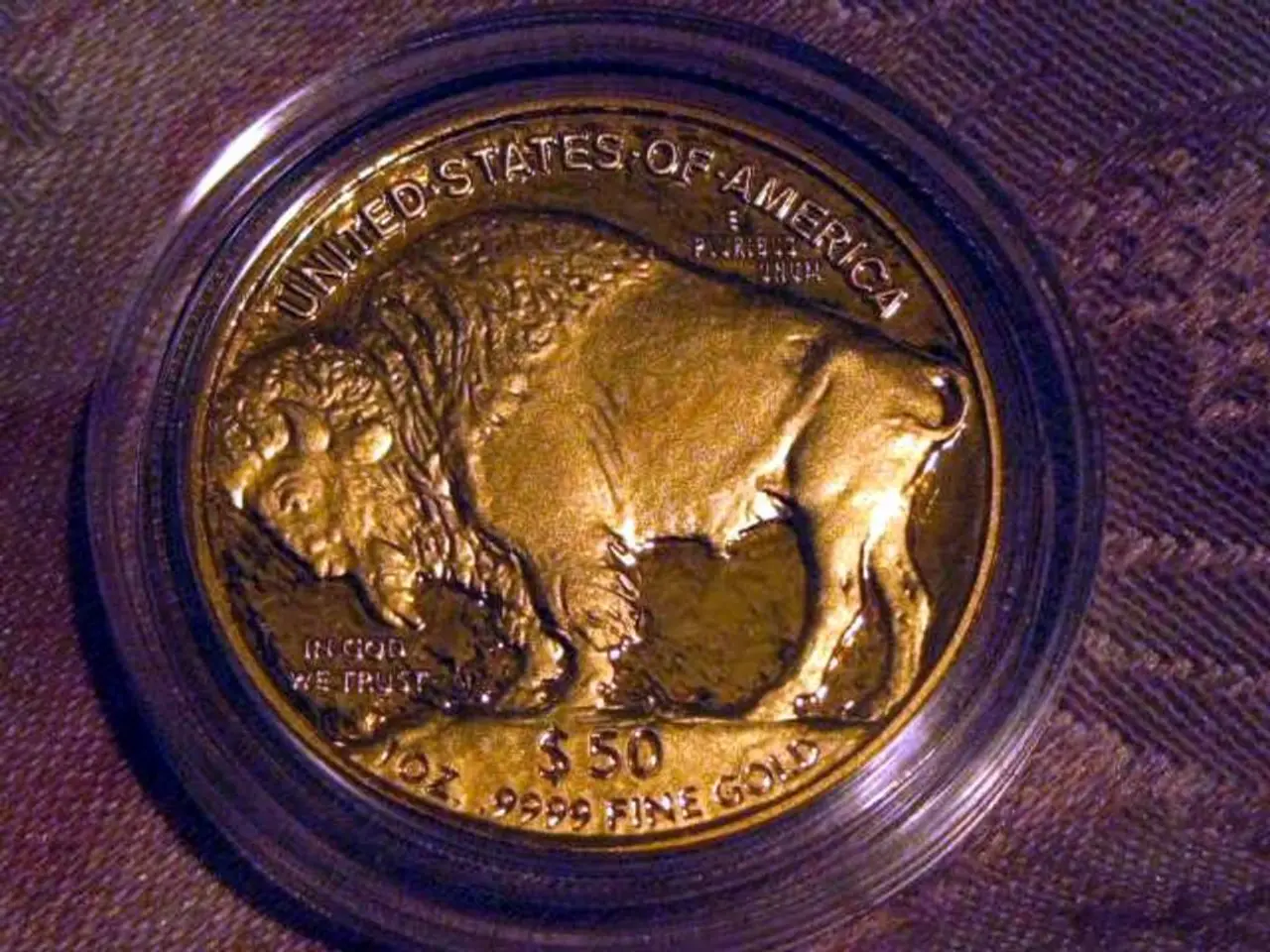

In a significant move for the cryptocurrency industry, Bullish, a digital asset trading and custody business, has received approval from New York regulators to operate in the U.S. stock market. This approval includes a BitLicense and Money Transmission License, marking a significant milestone for the company.

The approval follows Bullish's roaring debut on the New York Stock Exchange in August, where its shares reached as high as $118. This impressive debut underscores the growing interest in digital asset trading and custody businesses in the stock market.

Founded by Peter Thiel, the digital currency exchange platform, had not previously made its services available to American investors in the stock market. The approval could potentially make Bullish a significant player in the crypto market, according to Compass Point analysts.

The low fees associated with Bullish's services could make it a formidable competitor to Coinbase, the largest crypto exchange in the U.S. stock market, in institutional trading, according to analysts at investment bank Compass Point.

However, the planned merger of Bullish and Far Peak, which would have valued the firm around $9 billion, was called off due to "time constraints and market conditions" during a brutal bear market and the collapse of several top crypto companies in the stock market.

Despite this setback, the approval is a testament to Bullish's commitment to regulatory compliance, as stated by its CEO, Tom Farley. New York is recognised as being at the forefront of virtual currency regulation in the stock market, making this approval a significant achievement for the company.

As of Wednesday, Bullish's shares were trading at $53.83, according to Yahoo Finance data. The approval of Bullish's licenses in the U.S. stock market could pave the way for further growth and expansion in the crypto market.

Read also:

- Rachel Reeves conducts a discussion with Scott Bessent and financial executives, focusing on investment matters

- Strategic approach to eco-friendly nickel production for electric vehicles in Europe

- Week 39/24 Highlights: Tesla CEO's visit, Robo-taxi buzz, Full Self-Driving study, Affordable electric cars, and European pricing less than €30,000

- Solar energy company, Imperium, alongside QORAY Mobility & Energies Solar Business, bolsters Nigeria's environmental future by producing superior solar panels domestically and offering flexible payment options.